Your business may be owed money due to mis-sold energy contracts

We’ve helped hundreds of businesses make claims ranging from £5,000 to £2,000,000.

See how much you are owed in 3 simple steps

Simple Process to Apply Service.

Upload documents

We Will Review Documents

Sign Documents

Its Really That Simple

Here's An Example Of How It Works

Our Average Claim looks a little like this:

Contract 1: Gas Contract Length: 2 Years Energy Broker Rate (Uplift): 1 p/kWh Annual Consumption: 523,151 Energy Broker Commission: £10,463.02

Contract 2: Electricity Contract Length: 5 Years Energy Broker Rate (Uplift): 0.4 p/kWh Annual Consumption: 764,894 Energy Broker Commission: £15,297.88

Total Combined Commission: £25,760.90

Have You Been Mis-Sold To?

Energy brokers legally have to disclose any commissions earned, but many have made misleading statements or concealed their financial incentives over the years.

Over 90% of the businesses we’ve spoken to have used an energy broker, and our average claim is over £25,000, with some enterprises entitled to millions of pounds in energy compensation.

We believe upwards of 2 million businesses are entitled to compensation, and we’re here to make your energy claim as easy as possible.

How are energy brokers mis-selling?

Did your energy broker tell you how much they made from arranging your business contract? In our experience, most don’t, and there’s usually a good reason for that. Brokers know that if they had to fully disclose, they would not make anything like the kind of commissions they would do if everything were transparent. After all, would you sign up for a deal if you knew up to 75% of your energy bill was broker’s commissions?

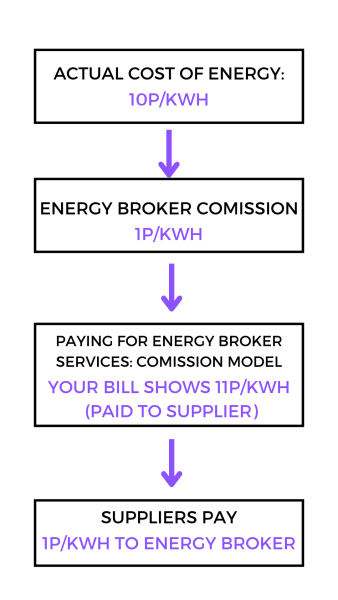

They may even have told you that the service was free or that the broker got their commission from the supplier as an “introducers fee” or words to that effect. Typically, most brokers receive their commission directly from the supplier they place you with, which is built into the unit price they arrange for you. Often, this is not disclosed to the customer.

The Business Energy Claims team is comprises legal energy experts with over 150 years of experience within their fields. This helps us to quickly identify if you have been mis-sold and, if so, recover that money on your behalf.

The process is very straightforward and hassle-free. All we need is a few bits of information to get started and process your claim:

- The name of the broker you used

- Copies of supply contracts or, if you don’t have these, copies of invoices

FAQ's

This is often the case, but this does not determine whether or not you have a claim. In many circumstances, it is conceivable that a broker can save you money because of the excessive deal you were on previously. But there can still be a substantial amount of hidden commission resulting in a claim.

Usually, brokers persuade clients to take a longer-term contract than a short term, claiming that the market will likely increase during this time. However, brokers are motivated to sell longer-term agreements, which are more appealing to them because the commission is multiplied by the length of the contract, usually representing a more significant claim amount.

Unfortunately, energy brokers are not regulated, and OFGEM has no powers (at present) to deal with them. We are pushing the likes of OFGEM, Citizens Advice, etc., to enforce a code of practice and regulate the industry. In the absence of regulation, we are looking to push for financial redress for businesses that have been mis-sold.

That could be the case, and usually, clients perceive that brokers earn a negligible sum that does not affect their energy costs. However, our average claim amount is over £25,000, which can extend to significantly higher. Our experience tells us that clients are usually shocked to find the true extent of the undisclosed commission amounts.

Because of the misrepresentations that can be made and how brokers can mislead, even the most astute finance directors and teams can be mis-sold to.

Start Your Claim

* You can find this on your Energy Contract or Invoice. For Electricity (MPAN Number) – this is usually displayed as series of boxes with numbers and always starting with a bold S, it is 21 digits long (on some contracts or invoices the MPAN shows only the bottom line of numbers, which is 13 digits long); for Gas (MPRN Number) – this is displayed as a number between 8 and 15 digits long.

** This is usually displayed on your contract (but not on an Invoice), along with the Contract End Date

*** Usually displayed on an Invoice

Please also attach copies of your Energy Contracts and 1-2 invoices from each year of your contract

Once you submit your information to us, we will get back within 24-48 hours providing you with an accurate calculation for your potential claim value.

If happy for us to subsequently proceed with submitting your claim, we will advise you on all further steps.

We completely agree. Ultimately energy brokers are businesses and ought to be paid. However, generally, brokers are paid by adding a margin to your rates which can occupy a significant proportion of your energy spend, and according to the duties that they owe to you, they ought to fully and frankly disclose this to you and the amount of their commission.